)

)

A licensed insurance professional, Courtney Levin has been a personal finance writer since 2016. She graduated from Sonoma State University with a degree in communications and has been creating content for Insurify for more than two years. She specializes in auto insurance and personal finance and strives to help customers understand the ins and outs of their insurance policies.

)

15+ years in content creation

7+ years in business and financial services content

Chris is a seasoned writer/editor with past experience across myriad industries, including insurance, SAS, finance, Medicare, logistics, marketing/advertising, and many more.

Featured in

Updated November 21, 2024

At Insurify, our goal is to help customers compare insurance products and find the best policy for them. We strive to provide open, honest, and unbiased information about the insurance products and services we review. Our hard-working team of data analysts, insurance experts, insurance agents, editors and writers, has put in thousands of hours of research to create the content found on our site.

We do receive compensation when a sale or referral occurs from many of the insurance providers and marketing partners on our site. That may impact which products we display and where they appear on our site. But it does not influence our meticulously researched editorial content, what we write about, or any reviews or recommendations we may make. We do not guarantee favorable reviews or any coverage at all in exchange for compensation.

Table of contents

If you’re taking your car insurance search online, you’re no doubt uncovering several new websites purporting to help you. And one you may have come across is Insure.com.

Insure.com is a lead-generation site that aims to simplify the insurance-buying process by breaking down pricing to help customers get the best rates. The site sets out to help users compare insurance policies from multiple insurance companies — then supplements this information with informative, up-to-date reviews from policyholders.

Insure.com allows you to compare coverages for home, life, auto, and health insurance.

You must leave the Insure.com site and click on insurer links to receive your quotes.

Customers have enjoyed a generally positive experience with Insure.com, according to survey information from Clearsurance.

Insure.com at a glance

Insure.com has been in business since 1999. The company is owned by the online marketing company Quinstreet. Both Insure.com and Quinstreet are based in San Mateo, California. Quinstreet maintains an A+ rating with the Better Business Bureau, though the company isn’t accredited.[1]

Reviews through the BBB are few and sparse, but Quinstreet has a rating of one out of five stars, though this comes from only 10 reviews. The company averages about one complaint per month on the BBB website and has responded in the past, showing it follows such issues.

Here’s a look at some pros and cons specific to Insure.com.

Tool can be used to shop for auto, life, health, and home insurance

“Ask the insurance expert” feature allows you to have your typed questions answered by an industry expert

Quotes not provided on the site; you must click the link and travel to the insurer’s website to get your quote

The company will sell your information unless you specifically opt out of this choice

How does Insure.com work?

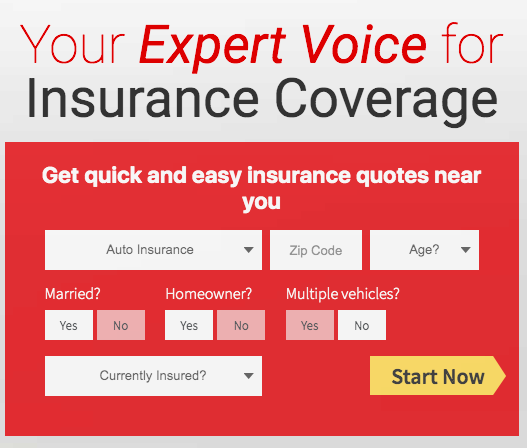

Insure.com saves you some trouble by letting you skip the drawn-out sign-up process. Instead, you can answer a few simple questions right on the homepage, then press “Start Now” to gain access to more information about insurance coverage.

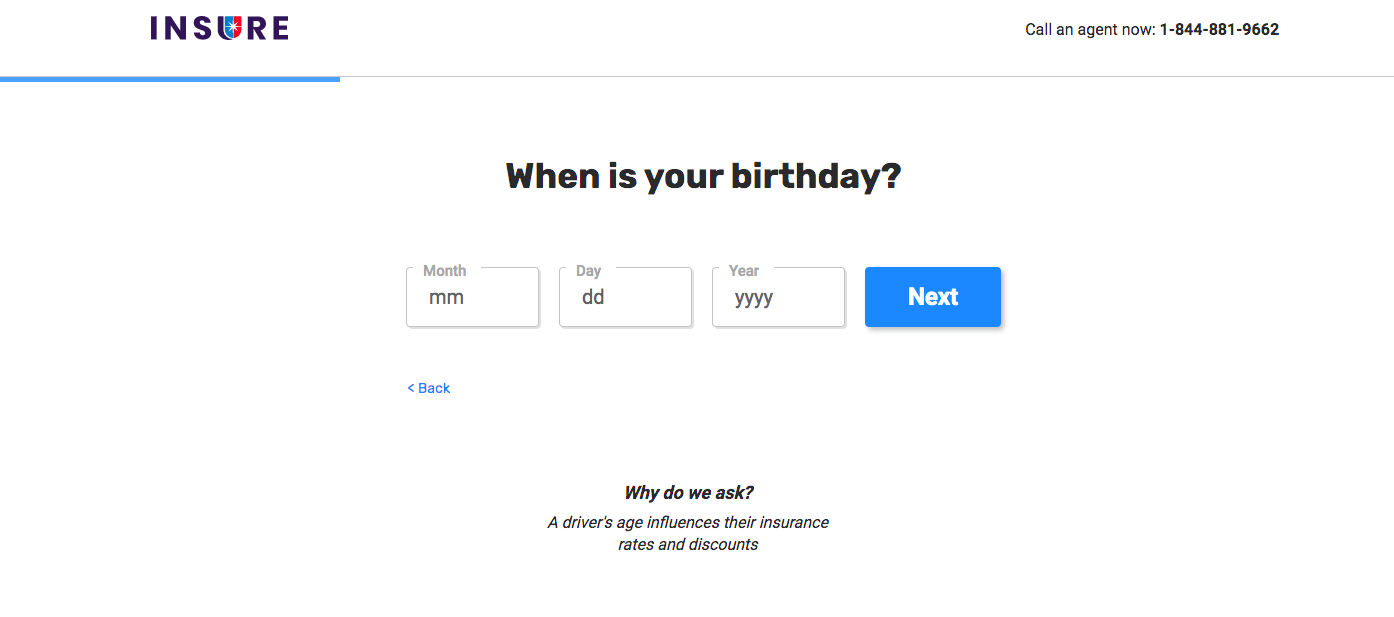

Then, it’s time to answer a few more questions about your background so the site is better able to provide accurate quotes on insurance rates. For instance, Insure.com needs to know if it’s your first time buying car insurance, as that may affect your rates.

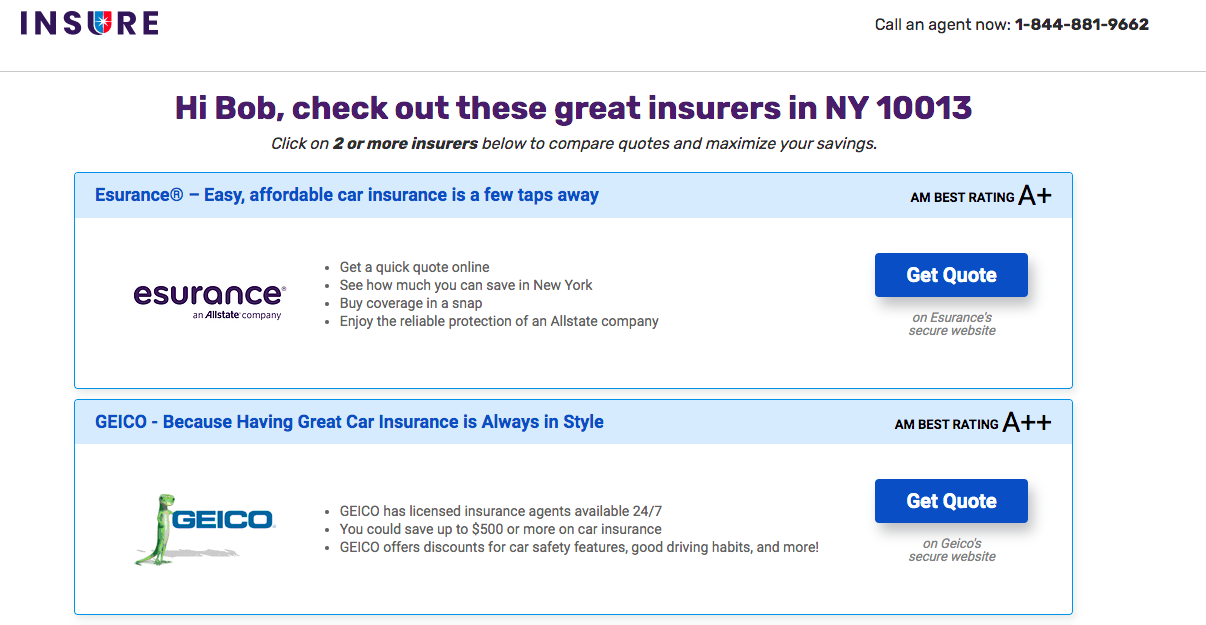

Once you’ve made it to the end of Insure.com’s questionnaire, you’ll have access to your free quotes. But keep in mind, these aren’t real-time quotes that were generated just for you. Instead, Insure.com will redirect you to some insurance companies’ sites, where you can further explore coverage options and access pricing information.

With this information in your back pocket, the folks at Insure.com hope you’re ready to reach out to an insurance agent and find a policy that works for your needs and budget.

Insure.com reviews: Here’s what customers are saying

Does it seem like customers enjoy their experiences with Insure.com? Does it help them find the right deal?

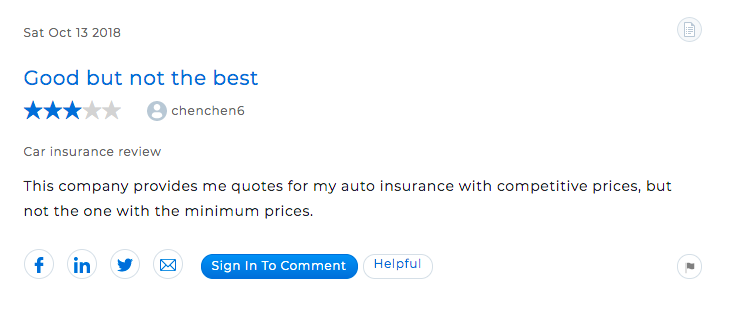

On Clearsurance, a website that helps people compare different insurance websites, several Insure.com users have weighed in with their experiences. The user below had a pretty positive experience with Insure.com. They might not have found the lowest prices after using the site, but they found a good deal.

Meanwhile, the following user was disappointed with their Insure.com experience. They didn’t have much luck finding a good deal, and then they were left with countless calls from car insurance companies.

This was a common criticism of Insure.com. While there isn’t a disclaimer on the website that says it shares your information with third parties, you should be aware that you might get a barrage of calls and emails if you enter your information on Insure.com.

One customer on Trustpilot had a similar experience.

)

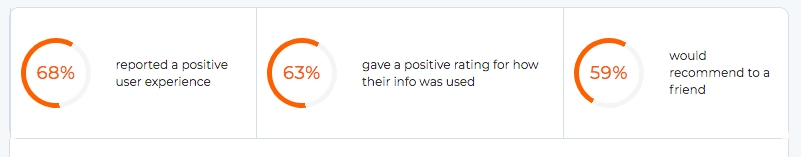

In general, Clearsurance’s customer satisfaction ratings paint a mixed picture of the Insure.com user experience.

As for financial strength, Insure.com has an A++ rating from AM Best and an AAA rating from Moody’s, indicating excellent financial strength.

Insure.com vs. Insurify

In general, Insurify and Insure.com have a similar user experience. Both skip the lengthy sign-up process and let you start answering their questionnaires in a matter of seconds. The questionnaires on both sites cover similar details and can be completed in a matter of minutes.

From there, things diverge. With Insurify, you’ll gain access to real-time quotes personalized to your exact needs and specifications. Meanwhile, Insure.com will direct you to the websites of auto insurance companies, home insurance companies, or life insurance companies, depending on your needs. Your information will be shared with these insurance companies, while Insurify won’t do that.

Insure.com vs. Gabi

Gabi wants you to stop overpaying for car insurance by making it easy to compare quotes. While the site flow of Gabi is similar to Insure.com — both sites have you answer questions then deliver results — Gabi delivers real quotes in real time. This means Gabi’s quotes are a bit more personalized and will probably lead to a few spam calls after you use the site.

For real quotes in real time and no spam calls after the fact, you’ll want to give Insurify a try. Whether you’re looking to work with a major insurer like GEICO or USAA or a smaller regional chain, Insurify has the proprietary data needed to connect you with great deals.

Recent quotes for other Insurify users

Drivers have found policies from Root, HiRoad, Kemper Economy, and more, for rates as low as $39/mo. through Insurify

*Quotes generated for Insurify users within the last 10 days. Last updated on November 21, 2024

*Quotes generated for Insurify users within the last 10 days. Last updated on November 21, 2024

Is Insure.com a spammy site?

User experiences captured in reviews show customers have received phone calls, texts, and emails after entering their information into Insure.com. The exact number of contacts varies, but some customer reviews say they received hundreds of messages.

Others report not receiving such communications after selecting the option to opt out and prevent Insure.com from selling their private information.

In all, 68% of respondents reported a positive user experience using Insure.com, according to Clearsurance’s report. For users considering entering information into Insure.com, it means you should take the time to understand what could happen and select the opt-out option if you don’t want further communication.

Insure.com FAQs

Looking to learn more about Insure.com? Consult the answers below.

Is Insure.com legit and safe to use?

Insure.com is a lead-generation site, which means it shares your information with third parties. While the website is safe to use, it may leave you with annoying spam calls after the fact.

What types of insurance can Insure.com compare?

When it comes to the type of insurance you can compare on Insure.com, you have options. You can compare pricing on car insurance, homeowners insurance, health insurance, life insurance, and even more specialized insurance services, like motorcycle coverage.

Is Insure.com easy to use?

Yes. Insure.com has a very clean, simple navigation system with straightforward directions to guide you through the quote process. Be prepared to answer several questions, but the steps are simple to follow. The “Why do you ask?” feature at the bottom of the page is a handy helper to guide you in how your answers affect your insurance quotes.

Is Insure.com free to use?

Yes, getting a quote is free. However, you should be aware you’ll need to leave the site and click on the link of an associated insurer to actually get your quotes. You should also know that Insure.com may sell your information to outside insurance agencies unless you specifically opt out.

Related articles

- The 10 Best and Worst Car Insurance Comparison Sites

- No-Down-Payment Car Insurance

- Top 10 Cheapest Car Insurance Companies

- How to Get Cheaper Car Insurance With a Low Income

- Best Cheap Full-Coverage Car Insurance

- 7 of the Best Car Insurance Companies

- Can Your Insurance Company Force You to Total Your Car?

Popular articles

- What Is Gap Insurance for Cars, and Do You Need It?

- How Much Will Insurance Pay for My Totaled Car? (Full Guide)

- What Is the Difference Between a Real ID and a Driver’s License?

- Rebuilt Title: What It Is and How It Works

- What Is a Car Insurance Deductible?

- Best Car Insurance Rates and Discounts for Teachers

- What Comprehensive Car Insurance Covers in Texas

Sources

- Better Business Bureau. "Quinstreet, Inc.."

)

A licensed insurance professional, Courtney Levin has been a personal finance writer since 2016. She graduated from Sonoma State University with a degree in communications and has been creating content for Insurify for more than two years. She specializes in auto insurance and personal finance and strives to help customers understand the ins and outs of their insurance policies.

)

15+ years in content creation

7+ years in business and financial services content

Chris is a seasoned writer/editor with past experience across myriad industries, including insurance, SAS, finance, Medicare, logistics, marketing/advertising, and many more.

Featured in

)

)

)

)

)

)