)

)

5+ years in auto insurance and personal finance writing

Featured in top personal finance publications

Lindsay is a widely published creator of auto insurance content. She also specializes in real estate, banking, credit cards, and other personal finance topics.

Featured in

)

Property and casualty insurance specialist

4+ years creating insurance content

Tanveen manages Insurify's data insights, annual home and auto insurance reports, and media communications. She’s regularly featured in media interviews on insurance topics.

Featured in

Updated November 21, 2024

At Insurify, our goal is to help customers compare insurance products and find the best policy for them. We strive to provide open, honest, and unbiased information about the insurance products and services we review. Our hard-working team of data analysts, insurance experts, insurance agents, editors and writers, has put in thousands of hours of research to create the content found on our site.

We do receive compensation when a sale or referral occurs from many of the insurance providers and marketing partners on our site. That may impact which products we display and where they appear on our site. But it does not influence our meticulously researched editorial content, what we write about, or any reviews or recommendations we may make. We do not guarantee favorable reviews or any coverage at all in exchange for compensation.

Insurance shopping may not be at the top of your priority list, but it’s an important step if you want to save money on your auto insurance. Rather than spending time comparing insurance quotes manually and completing a ton of research on your own, drivers can turn to sites like netQuote to find the best deals on their auto policy.

Other motorists lean on Insurify, a site that compares real-time quotes in a matter of minutes and can help you save hundreds of dollars per year on your policy. With millions of users and multiple awards to its name, Insurify takes the guesswork out of the insurance industry and provides drivers with real ways to save.

What is netQuote?

Instead of calling multiple insurance agents just to find the best pricing on car insurance, netQuote connects users with local agents. Once you provide netQuote with your vehicle information, driving record details, and more, it’s advertised that you’ll receive up to five quotes, many of which are from national insurance providers.

How does netQuote work?

While your initial visit to netquote.com might make you think you’re in the early 2000s, the insurance company’s interface is far more updated once you begin the quote process. It’s smart to gather your current vehicle specifications and insurance policy details before you get started, as netQuote does ask for a range of information before sending you auto insurance quotes.

More: Auto and Home Insurance Quotes

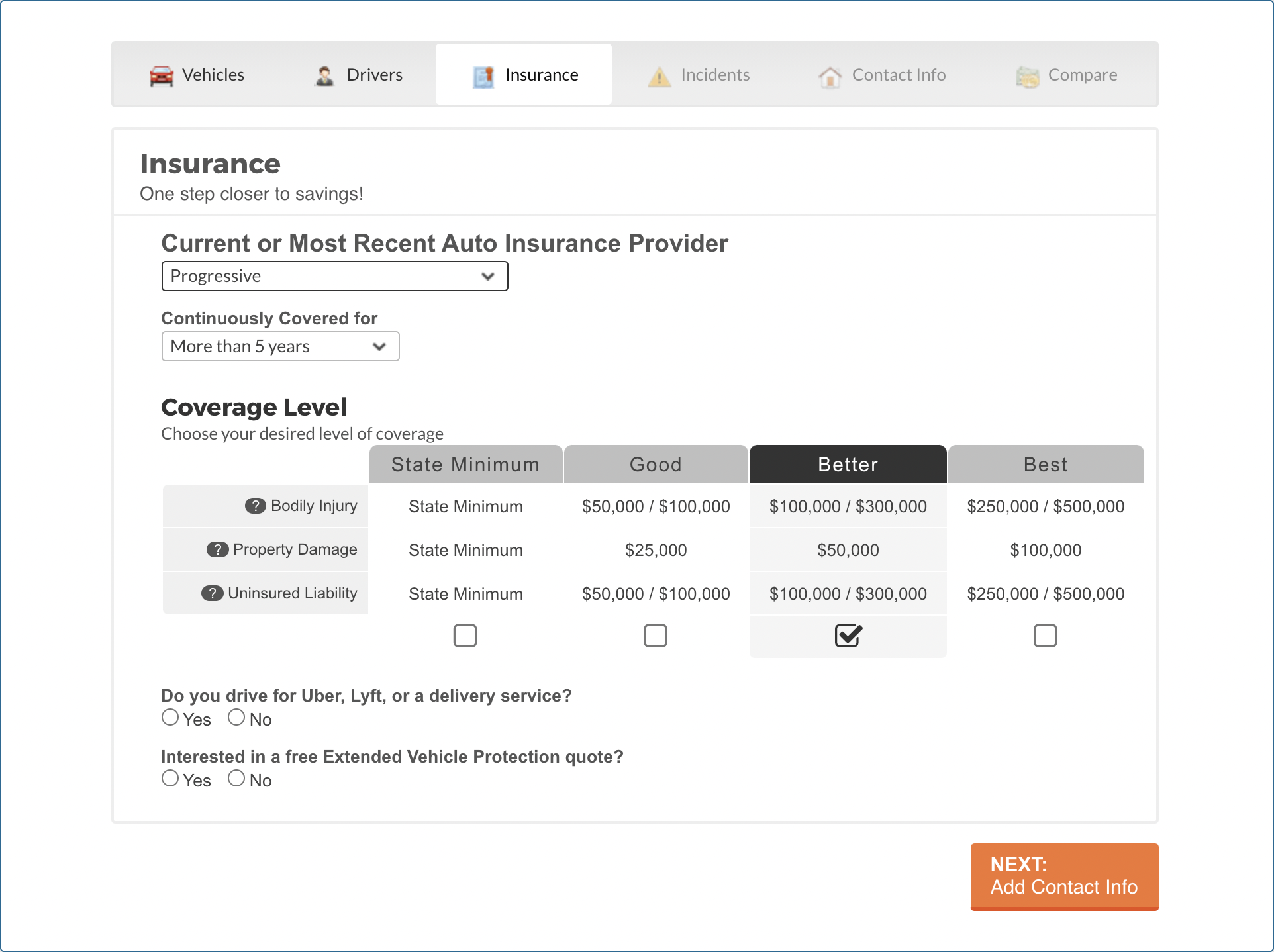

In an effort to provide customers with the most accurate quotes possible, netQuote asks for your current insurance company details and breaks down your policy limit options into a “good, better, best” system. You have the option to select state minimum coverage as well. If you have incidents on your driving record, you’ll also be prompted to verify those details.

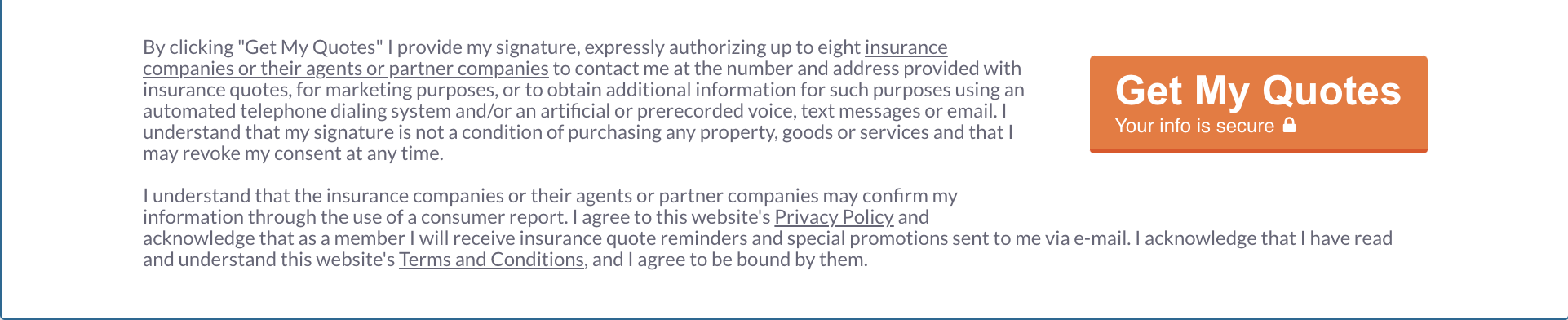

You won’t see your quotes instantly, as netQuote asks for your address and phone number before you click the “Get My Quotes” button. It should be noted, however, that the bottom of the page states that by submitting your information, you authorize up to eight insurance companies, agents, or partner companies to contact you.

More: Car insurance quotes

More: Cheap car insurance

netQuote Reviews: Here's what customers are saying…

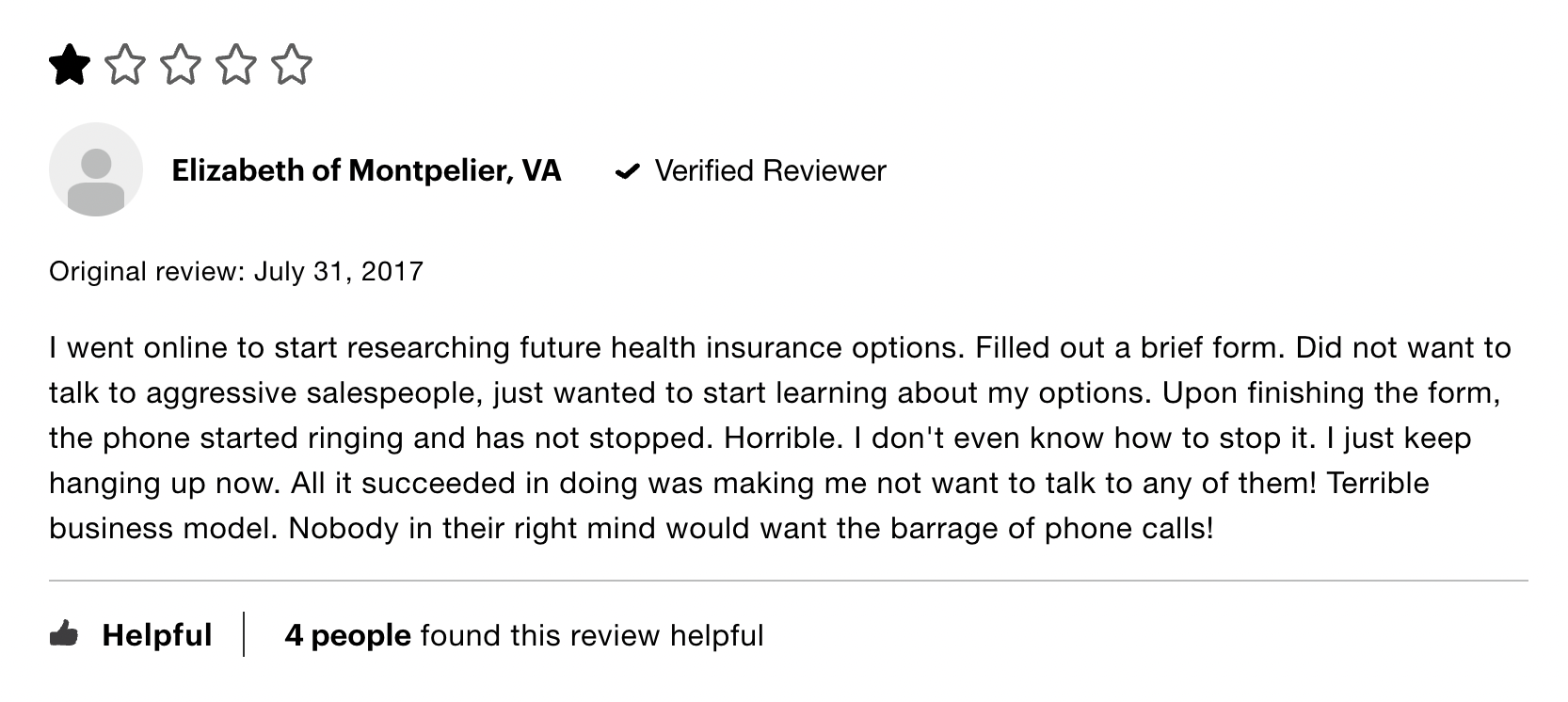

Customers consistently report the same experience when using netQuote, according to the Consumer Affairs website. Instead of offering customers a tool to compare auto insurance prices, netQuote appears to be a tool for agents to generate insurance leads. Customers complain about a high volume of emails and phone calls after using netQuote.

netQuote offers more than just auto insurance, and individuals who have requested quotes for health insurance describe having the same experience.

netQuote vs. Insurify: The Facts

Not all companies in the insurance comparison space are the same, and by and large, netQuote and Insurify are far different. One of several popular insurance-lead companies, netQuote doesn’t provide quotes directly to customers. Instead, it sends driver data to insurance agents and requires you to speak with each one individually to get pricing information.

Insurify, on the other hand, puts you in control of your personal information and allows you to compare real-time insurance quotes from multiple carriers. Drivers can even enroll in a new policy directly online and, in many cases, may never need to speak with an insurance agent to complete the process.

While both companies present a straightforward and easy-to-use design, only Insurify provides quotes at the end of the process. Customers tend to trust Insurify as a BBB-rated company, while netQuote, owned and operated by All Web Leads, is not accredited.

netQuote vs. QuoteLab

Some drivers visit QuoteLab when they’re shopping for new auto insurance, yet much like netQuote, this company operates as one of several industry lead providers. QuoteLab’s process is easy to complete, with straightforward questions that relate to your vehicle, driving history, and desired policy limits.

Just like netQuote, submitting your form authorizes QuoteLab’s partners to contact you. However, in this case, the clause at the bottom of the page states that pre-recorded messages, text messages, and automated dialing systems may be used even if your phone number is on the Do Not Call registry.

netQuote vs. QuoteWizard

Another lead service that promotes itself as a place to obtain insurance quotes is QuoteWizard. It asks more in-depth questions compared to netQuote and even brings up the option for customers to review additional policies like renters or homeowners coverage. QuoteWizard’s interface is also more streamlined compared to that of netQuote.

However, using QuoteWizard brings the same result as netQuote in that your information will be distributed to insurance agents and added to telemarketing lists. Ultimately, only Insurify actually provides drivers with quotes at the end of its questionnaire and lets drivers view policies they can enroll in without having to speak to an insurance agent.

How to Save on Car Insurance

You don’t have to speak with a large number of insurance professionals to save on your auto insurance. Insurify puts you in control of your car insurance policy with real-time quotes for policies that you can enroll in automatically. If you’re looking to save money on your coverage, make sure to keep these tips in mind:

Consider the age of your vehicle. Older cars are often cheaper to insure while still offering you reliable transportation.

Opt for a higher deductible, as long as you’ll be able to pay it in the event of a claim.

Only purchase as much coverage as you need. If you use your vehicle sparingly, you may not need a robust policy.

Remember, auto insurance is a personalized purchase and should be carefully considered instead of opting for the cheapest rate available.

More about netQuote

Headquartered in Colorado, netQuote claims that it has been providing customers with insurance quotes since 1989. Well-known financial services company Bankrate acquired the organization in 2010 as its largest disclosed transaction to date.

In January 2016, netQuote was acquired by All Web Leads and will eventually transition over to that company’s interface. It’s unclear if the URL www.netquote.com will still be utilized by customers in the future, as insurance agents are instructed to contact All Web Leads directly for lead information.

Contact Information: All Web Leads

Headquarters: 1860 Blake St Ste 900, Denver, CO 80202-1264

Phone: +1 (303) 382-8298

Frequently Asked Questions

Is netQuote legit and safe to use?

Many customers claim that netQuote is a site that gathers web leads and distributes them to insurance agents, who will persistently call and email in an attempt to sell you auto insurance. netQuote is not accredited by the BBB and may not be safe to use.

What types of insurance can netQuote compare?

netQuote offers more than just auto insurance quotes, as the company can also generate information for business insurance policies, life insurance options, homeowners coverage, and more. netQuote advertises that customers can receive quotes for various types of policies by filling out one simple form.

What are the differences between netQuote and Insurify?

While both sites promise drivers that they can compare multiple auto insurance quotes in a matter of minutes, only Insurify provides this data without requiring drivers to speak with an insurance agent. Insurify is designed for motorists, while netQuote is known for providing quality leads to insurance agents across the nation.

Rather than speak with dozens of insurance professionals, you can get multiple real-time quotes from Insurify and enroll in a new policy online. Insurify saves you time and money and protects your contact information.

Methodology

Insurify data scientists analyzed more than 90 million quotes served to car insurance applicants in Insurify’s proprietary database to calculate the premium averages displayed on this page. These premiums are real quotes that come directly from Insurify’s 50+ partner insurance companies in all 50 states and Washington, D.C. Quote averages represent the median price for a quote across the given coverage level, driver subset, and geographic area.

Unless otherwise specified, quoted rates reflect the average cost for drivers between 20 and 70 years old with a clean driving record and average or better credit (a credit score of 600 or higher).

Liability-only premium averages correspond to policies with the following coverage limits:

- Bodily injury limits between state-minimum rates and $50,000 per person, $100,000 per accident

- Property damage limits between $10,000 and $50,000

- No additional coverage

- Comprehensive coverage with a $1,000 deductible

- Collision coverage with a $1,000 deductible

Quotes for Allstate, Farmers, GEICO, State Farm, and USAA are estimates based on Quadrant Information Services’ database of auto insurance rates.

Related articles

- The 10 Best and Worst Car Insurance Comparison Sites

- No-Down-Payment Car Insurance

- Top 10 Cheapest Car Insurance Companies

- How to Get Cheaper Car Insurance With a Low Income

- Best Cheap Full-Coverage Car Insurance

- 7 of the Best Car Insurance Companies

- Can Your Insurance Company Force You to Total Your Car?

Popular articles

- What Is Gap Insurance for Cars, and Do You Need It?

- How Much Will Insurance Pay for My Totaled Car? (Full Guide)

- What Is the Difference Between a Real ID and a Driver’s License?

- Rebuilt Title: What It Is and How It Works

- What Is a Car Insurance Deductible?

- Best Car Insurance Rates and Discounts for Teachers

- What Comprehensive Car Insurance Covers in Texas

)

Lindsay Frankel is a content writer specializing in personal finance and auto insurance topics. Her work has been featured in publications such as LendingTree, The Balance, Coverage.com, Bankrate, NextAdvisor, and FinanceBuzz.

)

Property and casualty insurance specialist

4+ years creating insurance content

Tanveen manages Insurify's data insights, annual home and auto insurance reports, and media communications. She’s regularly featured in media interviews on insurance topics.

Featured in

)