Is earthquake insurance worth it in Washington?

Depending on the risk level of your area, having earthquake insurance can save you big financially in the long run. It's always worth getting a quote.

Homeowners in Washington have a higher than average risk of earthquakes. With the potential for so much damage, how can you protect yourself and your home?

Earthquake insurance is an important consideration for Washingtonians, especially because standard homeowners insurance doesn’t cover earthquake damage.

If you’re wondering whether it’s right for you, we’ve got the answers you’re looking for. Keep reading to find out what Washington earthquake insurance covers, what it doesn’t, how much it costs, and where to buy a policy.

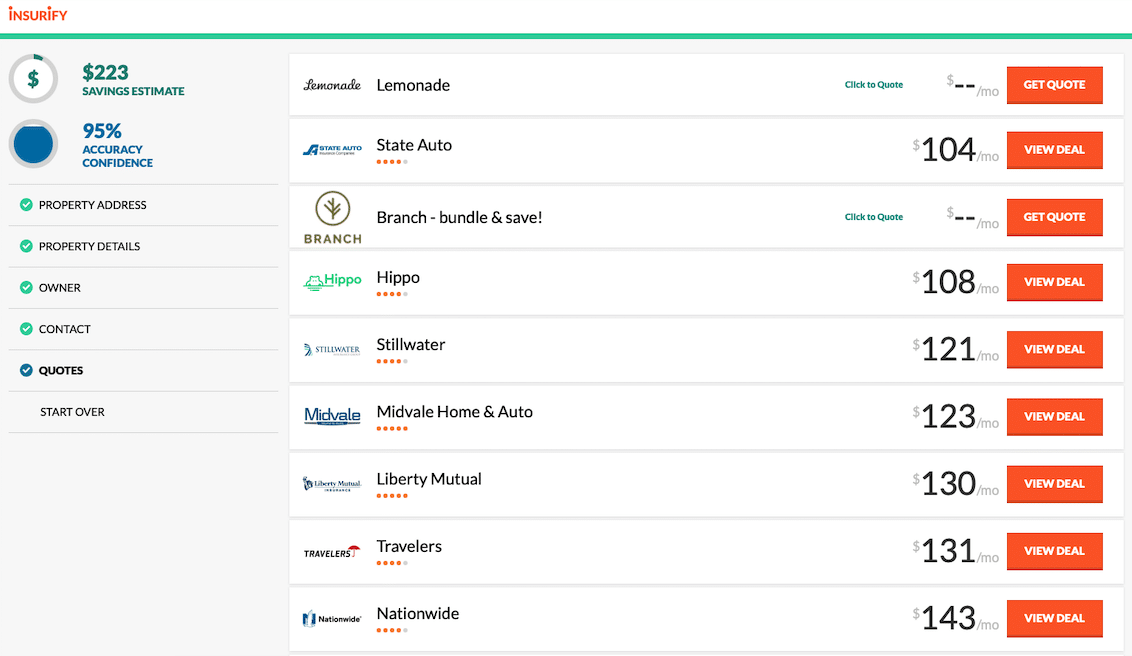

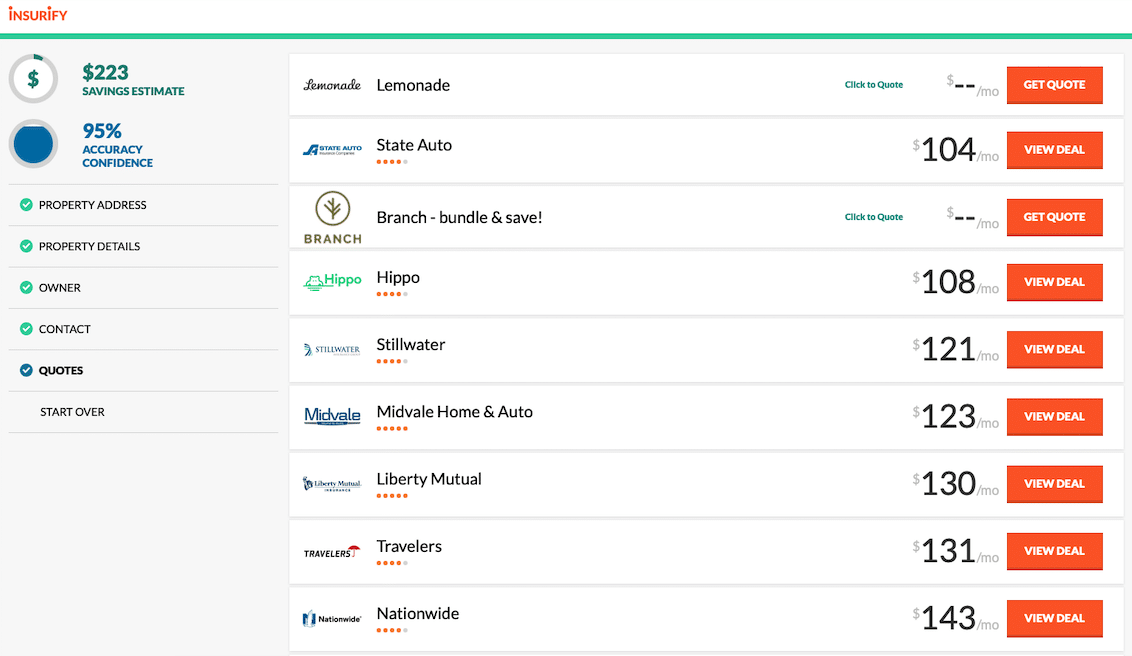

But remember: you also need homeowners insurance to protect your home. With Insurify’s free home insurance comparison tool, you can search and compare quotes from up to a dozen or more companies in less time than it takes to make a cup of coffee.

Washington Earthquake Insurance: The Basics

Earthquake insurance is pretty much what it sounds like: it’s insurance that protects you financially from damage caused by earthquakes. It generally covers your home’s structure, personal belongings, debris removal, and some additional living expenses.

Like most insurance policies, earthquake insurance has exclusions, policy limits, and deductibles.

Insurers often base coverage limits on your homeowners insurance policy. High deductibles are common with earthquake insurance coverage and can range from 10 to 25 percent of the coverage limit.

Before purchasing earthquake coverage, make sure you understand the deductible amount you’re responsible for on each claim.

Isn’t Homeowners Insurance Enough?

Unfortunately, Washington homeowners insurance isn’t enough when it comes to earthquakes. That’s because standard homeowners policies don’t cover earthquake damage.

According to the Washington State Department of Natural Resources, earthquakes occur nearly every day. While most are too small to notice, Washington has the second-highest risk in the U.S. of a large and damaging earthquake.

With the increased risk, earthquake insurance coverage can be a crucial part of being a Washington homeowner. Many insurers offer it as an add-on to an existing policy, but it can also be purchased separately.

What Earthquake Insurance Covers

Dozens of active fault lines and fault zones are scattered throughout Washington. The largest active fault in the Pacific Northwest is the Cascadia subduction zone. It’s the one that’s most likely to affect Washington.

The last major earthquake was the Nisqually quake in 2001. Another one is inevitable, but it’s tough to predict exactly when it will happen.

Before disaster strikes, take the time to understand what earthquake insurance covers:

Additional living expenses coverage is an important part of earthquake insurance. It can pay for a hotel or other accommodations if you can’t live in your home while repairs are done.

Your policy may also cover structures not attached to your house, increased expense to bring your home up to date with current building codes, and costs to stabilize the land under your home.

If you aren’t sure, check with your insurance agency to get a clear understanding of what your policy includes.

What Earthquake Insurance Doesn’t Cover

Earthquake insurance only covers damage caused by quakes. It likely won’t cover floods, tidal waves, or tsunamis, even if an earthquake causes them.

Here’s what else it doesn’t cover:

Your homeowners insurance may cover fire damage following an earthquake. And check with your Washington car insurance company to find out if your policy covers damage to your vehicles.

Remember that coverage can vary. It’s best to check with your insurance agent to find out any exclusions to your policy.

Cost of Earthquake Insurance in Washington State

How much you pay for earthquake insurance depends on a few factors. The age, size, location, and construction materials of your home can impact your rate.

The average cost can range from $100 to $300 for most states. However, you’ll likely pay more in Washington because the area is more prone to earthquakes than other parts of the U.S.

Premiums can cost around $800 per year in West Coast states like Washington, California, and Oregon.

Washington Earthquake Insurance Companies

If you’re looking for a Washington earthquake insurance policy, start with your existing insurance provider. Many insurers offer quake coverage as an endorsement to homeowners and renters insurance policies.

Coverage is also available as a separate policy. GeoVera and Arrowhead Insurance are two well-known companies that offer more robust coverage. They write their own policies for Washington earthquake insurance.

It pays to shop around for earthquake insurance. Since it’s available as an add-on to most homeowners policies, use Insurify to compare home insurance prices. Ask about the cost of adding earthquake coverage, and find out how much you could save by taking a few minutes to compare rates.

Washington Earthquake Insurance: The Bottom Line

Many fault lines run through Washington state. Earthquake insurance can go a long way to giving you the peace of mind that your home and belongings are covered if disaster strikes.

Policies can be costly because of the high risk of quakes in the state. However, many insurers allow you to add quake coverage to an existing homeowners or renters policy. Contact your insurance agent for a price quote and coverage options.

)

)

)

)

)