Los Angeles and Cincinnati’s NFL teams are about to face off in Super Bowl LVI. The players may be a fair match, but how about each city’s drivers?

This weekend, the Los Angeles Rams and the Cincinnati Bengals will clash in what’s sure to be an exciting Super Bowl LVI. But while the central contest will take place on the football field, it’s no secret that Americans love competition of any kind, especially when it’s a way to claim regional supremacy. Los Angeles and Cincinnati have their own distinct cultures that fans of each are sure to disagree on: SoCal street tacos vs. Cincinnati’s Skyline Chili; sprawling megalopolis vs. small city atmosphere; endless sun vs. all four seasons; the list goes on.

One topic that Americans love to talk (and complain) about, however, is driving. Questions of which cities have the best, the worst, or the most aggressive drivers are constantly up for debate. In light of the coming Super Bowl between Los Angeles and Cincinnati, the data scientists at Insurify decided to declare the Super Bowl of Driving 2022 champion. Curious to see how motorists in these two cities stack up against each other, the research team at Insurify turned to their database of over 4.6 million car insurance applications and determined the winner of 2022’s Super Bowl of Driving.

Los Angeles vs. Cincinnati Driving Breakdown

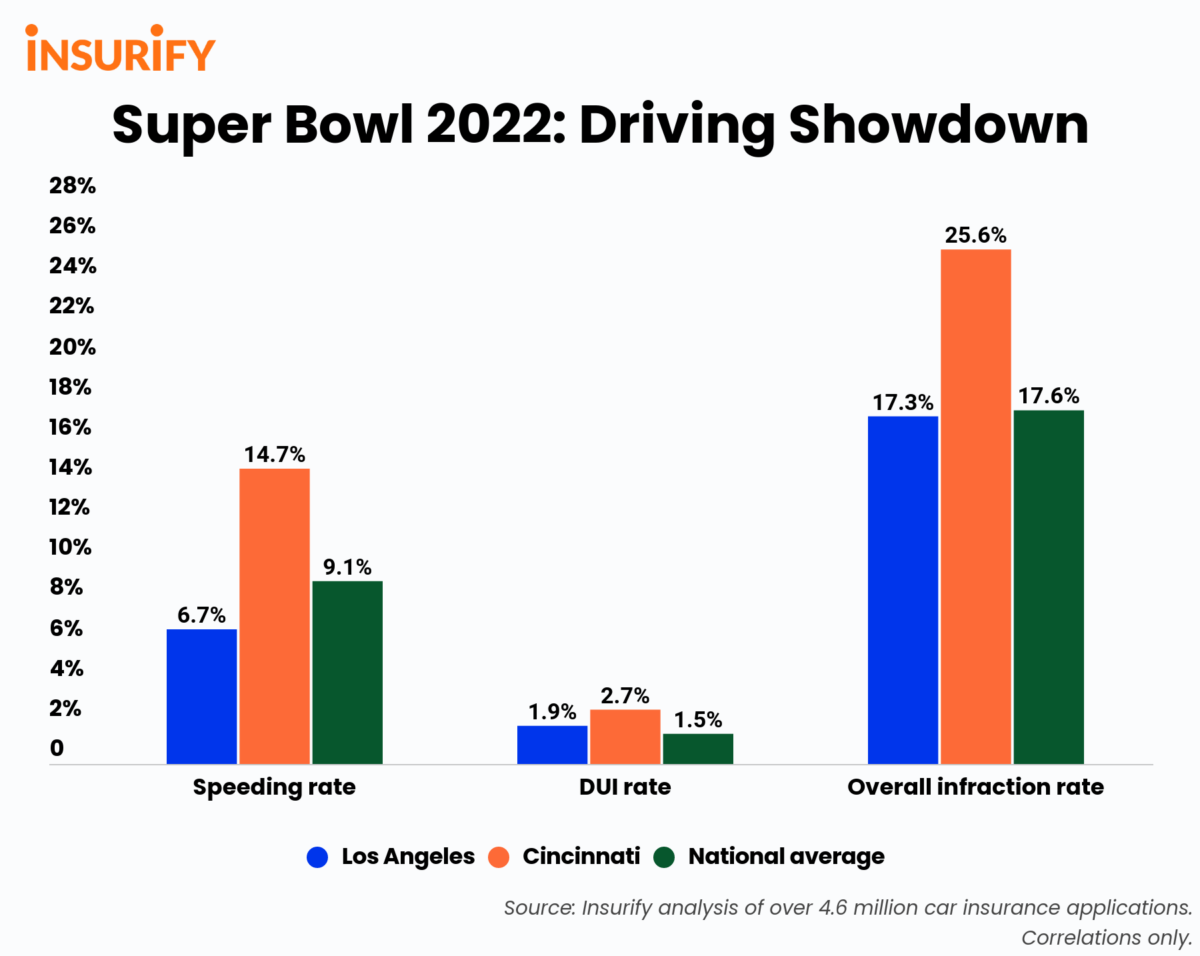

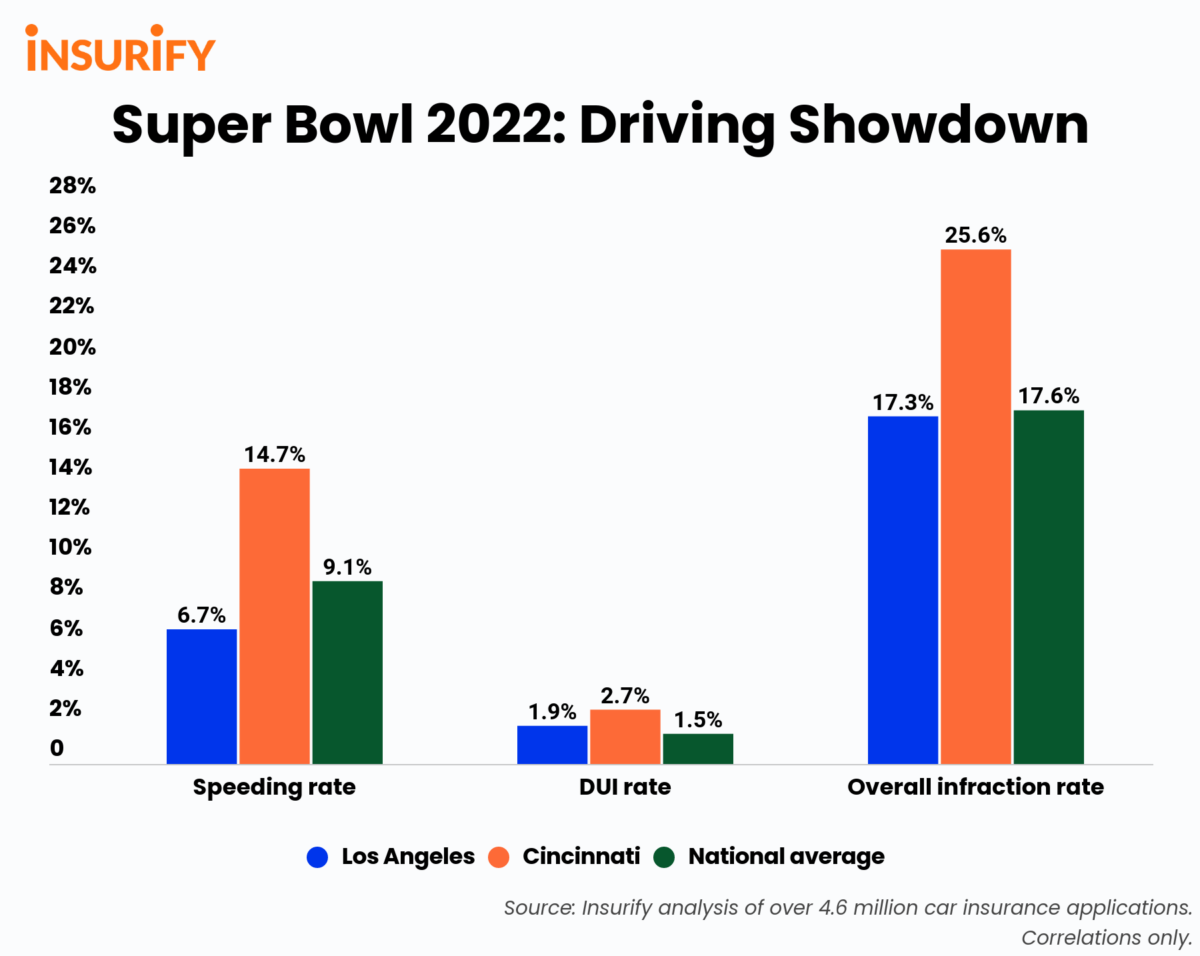

In the first head to head category — speeding tickets — Los Angeles drivers are the clear winners when it comes to exhibiting caution behind the wheel. Nationally, 9.1% of drivers have a prior speeding ticket on record, but only 6.7% of LA drivers fall into the same category. Perhaps Los Angeles motorists are among the most careful in the nation, or perhaps they’re just always caught up in the city’s infamous traffic! Cincinnati drivers, meanwhile, accrue speeding tickets 62% more often than the national average, and are nearly 2.2 times more likely than Los Angeles drivers to report a speeding ticket on record.

Trending On Insurify

It’s the talk of the town–Insurify’s car insurance quotes comparison site is the best way to save money on auto insurance. All online, in real-time: insurance shopping has never been this easy.

Ever wonder what’s the simplest way to find cheapest insurance in California? Insurify’s experts have answers to all your coverage-related questions and more.

When it comes to drunk driving, Cincinnati and Los Angeles motorists do so at more similar rates, though it’d be wrong to declare either a “winner” in this category. That’s because both Los Angeles and Cincinnati have DUI rates well above the national average by 29%, and a whopping 83%, respectively. While both cities have limited public transportation systems, that’s no excuse for their elevated DUI rates, especially in the age of rideshare transportation. Los Angeles and Cincinnati drivers would be wise to exhibit more common sense next time they’re planning a night out.

Trending On Insurify

Find cheap insurance in Florida by comparing between multiple providers, all on Insurify’s easy-to-use, one-stop-shop platform.

For Lone Star drivers, getting the cheapest car insurance in Texas is fast and simple when you let Insurify compare personalized quotes to find the best option for your wallet. See how much you could be saving today!

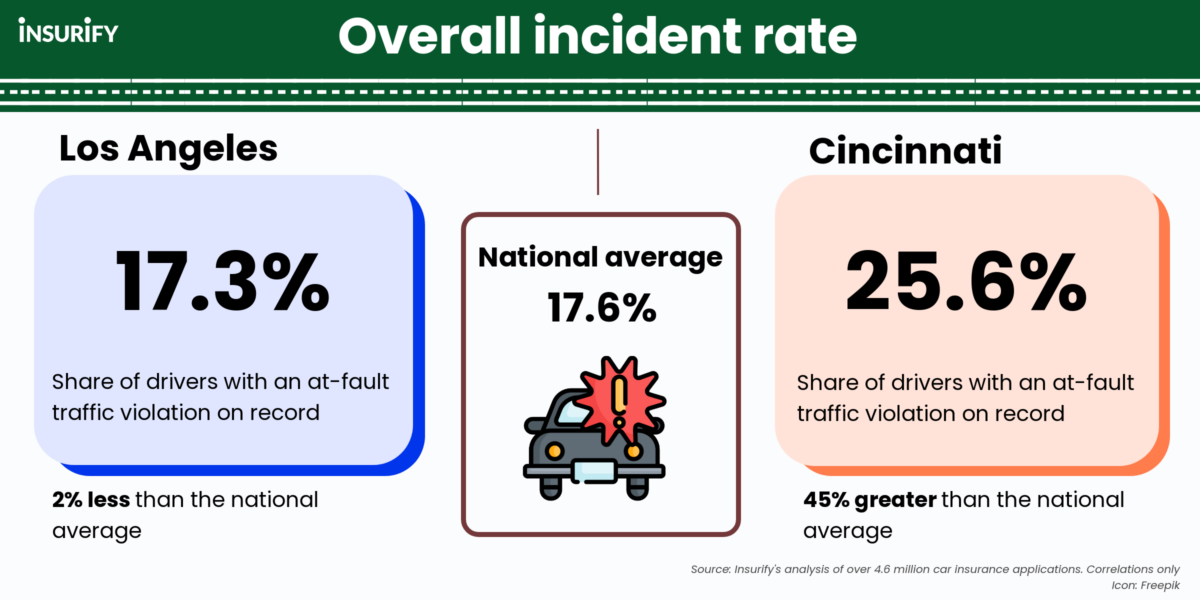

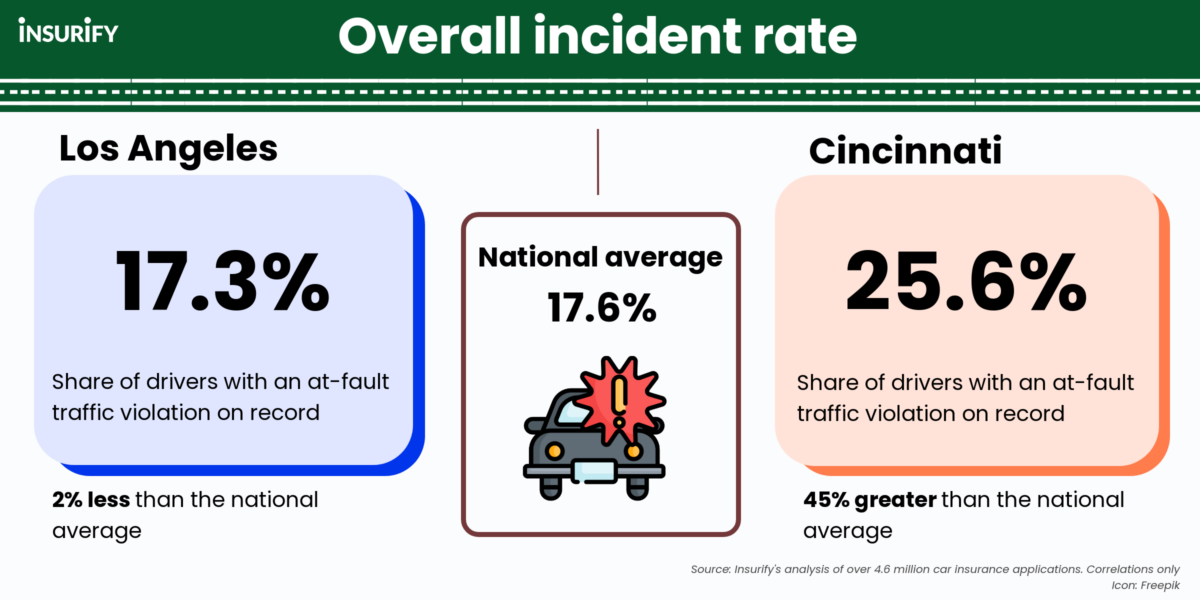

To definitively answer the question of which city has the better drivers, it’s best to look at Cincinnati and Los Angeles’s overall traffic incident rates. By this measure, Los Angeles takes the crown as the Super Bowl of Driving 2022 champion! 17.3% of LA drivers have a prior at-fault traffic violation on record, which is just below the national average rate of 17.6%. Meanwhile, 25.6% of Cincinnati drivers report a violation on record, which is a full 45% greater than the national average. No matter what happens on the field this weekend, Los Angeles residents are free to brag that they are at the very least better drivers than their Cincinnati counterparts.

Methodology

The data scientists at Insurify, a site to compare car insurance quotes, referred to their database of over 4.6 million car insurance applications to identify which city — Cincinnati or Los Angeles — has better drivers in 2022.

When applying for car insurance, applicants disclose their city and state of residence and any prior violations on their driving record within the last seven years. Insurify’s data scientists compared the number of drivers with one or more at-fault violations on record (including accidents, DUIs, failures to stop, speeding, reckless driving, passing violations, and other citations for illegal driving behavior) to the total number of drivers applying for car insurance in both Cincinnati, Ohio, and Los Angeles, California. The Insurify research team performed the same analysis specifically for speeding and DUI violations as well. Insurify data scientists ultimately declared the city with a lower share of drivers with a violation on record to be the Super Bowl of Driving 2022 winner.

The findings in this article represent statistical trends found in Insurify’s database of over 4.6 million car insurance applications. The findings of this study are not meant to imply the direction nor necessarily the existence of a causal relationship. Rather, this is a presentation of statistical correlations of public interest.

Data Attribution

The information, statistics, and data visualizations on this page are free to use, we just ask that you attribute any full or partial use to Insurify with a link to this page. Thank you!

If you have any questions or comments about this article or would like to request the data, please contact [email protected].

)

)

)

)

)

)

)