Clearsurance vs. Insurify: The Facts

While Clearsurance and Insurify promise to help users find more affordable insurance policies, how do these two quote-comparison options stack up against each other?

User Experience: Clearsurance and Insurify offer a fairly similar user experience. Both avoid drawn-out signup processes and instead let users get started right away. And both websites enable you to access quotes in seconds after answering questions about your vehicle and driver history.

Policy options: Insurify places an emphasis on quotes from car insurance companies and homeowners insurance companies. The Insurify blog also provides a wealth of content about health, life, and renters insurance. Meanwhile, Clearsurance enables users to compare auto, home, life, health, and renters insurance quotes.

Expertise: While both websites have satisfied many users, Insurify has been in the quote-comparison game a bit longer than Clearsurance. Insurify has served millions of users, has a user rating of 4.8 out of 5 stars, and won Best Insurance Company honors in 2016 and 2017.

Privacy: Both websites take user privacy very seriously. Insurify lets users know that their data is encrypted and never sold to third parties. Clearsurance and Insurify also never spam you with emails and texts. Insurify even enables you to manually schedule when you receive email and text notifications from them.

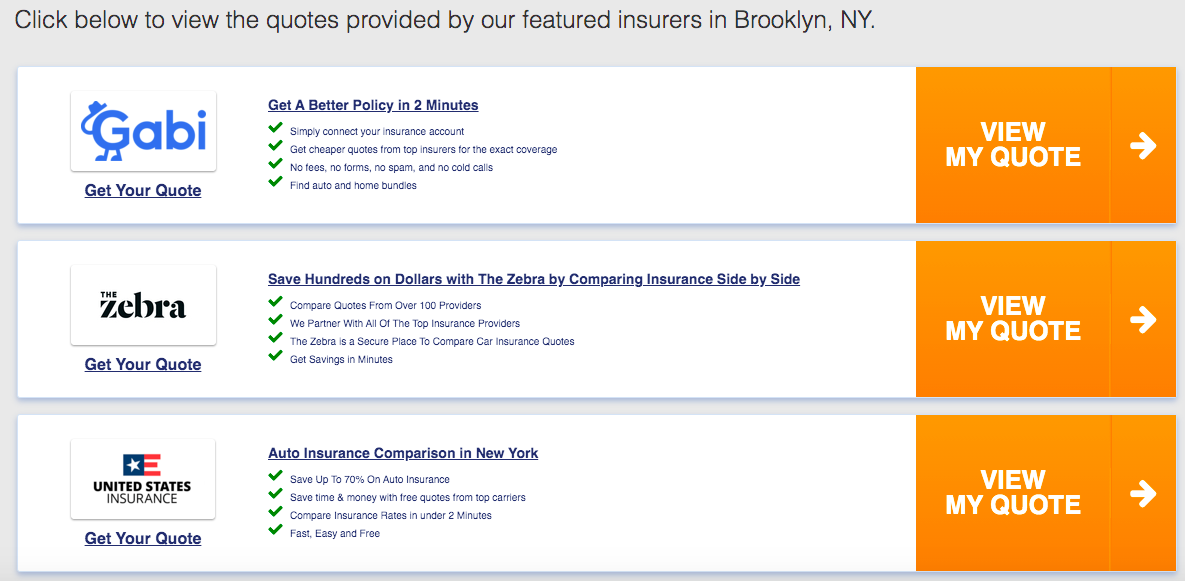

Clearsurance vs. The Zebra

The Zebra has been a major player in the insurance-comparison space for years now. But how does The Zebra compare to Clearsurance?

Both market themselves as unbiased, independent tools that help drivers and homeowners find the best insurance companies for their personal needs. The Zebra and Clearsurance also provide a similar user experience, enabling users to simply enter their ZIP code to get up and running. And after you enter your information, both sites promise to never spam you.

One difference between these insurance tools is that The Zebra only enables you to research home and auto insurance, while Clearsurance gives you the option to access quotes for auto, home, renters, life, and health insurance.

Clearsurance vs. Jerry

Jerry is a fast-growing online “insurance shopper” that contacts your current insurance company to figure out your coverage details, then compares this price to prices from up to 45 other insurance companies. While Jerry is similar to Clearsurance in that it makes it easier to compare quotes, it’s aimed at people who already have insurance and want to check if there are better options out there.

In general, Clearsurance is a better choice if you’re buying car insurance for the first time, while Jerry is better if you’re about to renew your policy and want to check the lay of the land. That said, neither compares to Insurify when it comes to easy, comprehensive quote comparison. With Insurify, you’re just a few clicks away from insurance quotes from a wide range of carriers.

)

)